On December 30, 2019, Ms. Cao of Wuhan reported to the complaint platform of the quality report that she bought a Cadillac XT5 sedan during the Wuhan Auto Show in November, signed a car booking agreement on the spot and paid a deposit of 10,000 yuan; However, when he was told to pick up the car at the end of December, he was told by the 4S shop that he needed to temporarily increase the price by 6,500 yuan, otherwise he would not leave the car.

On January 2, 2020, the customer service staff of Wuhan Hengxin Xingkai Automobile Sales & Service Co., Ltd., which belongs to the 4S shop involved, told The Paper that the car booking price was supported by the manufacturer during the auto show, but because the customer picked up the car after the time supported by the auto show price, he could only raise the price or refund the deposit of 10,000 yuan. In addition, the vehicle booking agreement signed at the time of car booking is invalid because it is not signed by the sales consultant.

Xing Xin, a partner of Hunan Jinzhou Law Firm, believes that the 4S shop asked for a fare increase when communicating with Ms. Cao to pick up the car, which shows that the validity of the agreement has not been denied. Ms. Cao has the right to protect her rights and interests by bringing a lawsuit to the court.

Ms. Cao introduced that in November 2019, at the booth of Cadillac at Wuhan International Expo Center Auto Show, she ordered a black Cadillac XT5 sedan on the spot. After many times of communication with the sales, the price was 275,700 yuan. On the same day, she signed a car booking agreement and paid a car purchase deposit of 10,000 yuan. It was agreed with the sales that the date of picking up the car was "before New Year’s Day".

After booking the car, Ms. Cao repeatedly asked about the time of picking up the car, and was told by the 4S shop that the booked car had not arrived at the store. On December 27th, the sales staff of 4S shop contacted Ms. Cao, saying that the car could be picked up, but it needed to increase the price by 6,500 yuan, otherwise the car booking agreement signed during the auto show would be invalid.

Ms. Cao said that at the auto show, the salesperson told her that there was a special preferential price during the auto show, and she could not get this discount after the auto show. She only paid the deposit and signed a car booking agreement during the auto show.

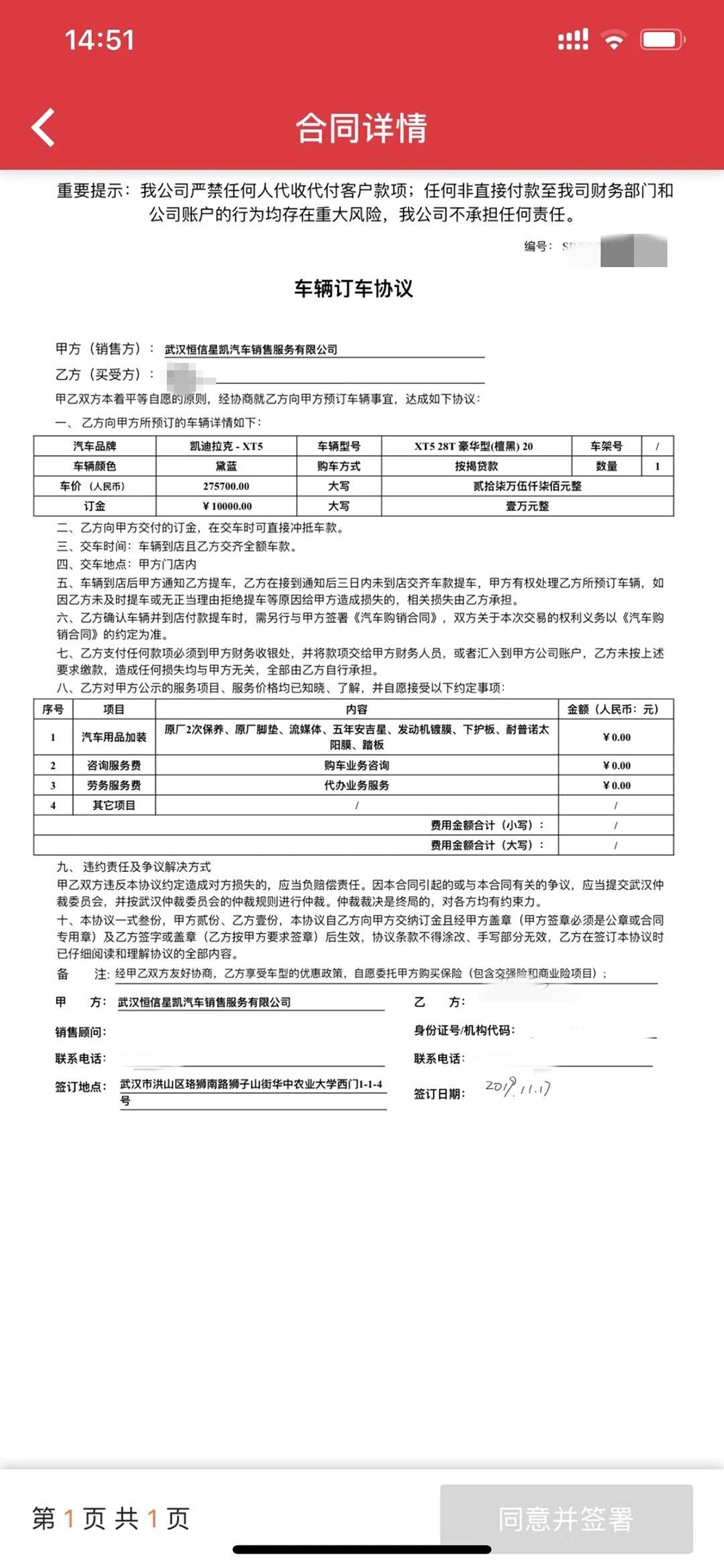

Vehicle booking agreement signed by Ms. Cao and 4S shop Photo courtesy of the interviewee

As can be seen from the car booking agreement provided by Ms. Cao, the agreement clearly indicates that the car price of the reserved car is 275,700 yuan, the delivery time is "the car arrives at the store" and Party B pays the full amount of the car, but it does not mention the specific time of picking up the car and the effective period of the car price.

It is stated in the agreement that the agreement can take effect only after Party A (4S shop) seals it and Party B signs it, but there is no company seal or sales consultant signature on the agreement.

On January 2, The Paper called Wuhan Hengxin Xingkai Automobile Sales & Service Co., Ltd., which belongs to the 4S shop involved. The customer service staff of the company said that in November, the customer signed an order for car booking at the auto show, and the price at that time was indeed supported by the manufacturer’s price. However, because the customer picked up the car after the auto show price support time, he could only pick up the car at a higher price.

"If the customer picks up the car in November, we can still follow the agreed price, but now the price has gone up, from 275,700 to 282,700, and there is nothing we can do." The customer service said that the vehicle booking agreement needs to be signed by both the customer and the sales consultant, but Ms. Cao’s vehicle booking agreement is only signed by the customer and not signed by the sales consultant, which is an invalid agreement.

In this regard, Ms. Cao said that the current status of the electronic agreement is indeed that the sales are pending. "But when booking a car, the agreement is operated by 4S shop sales on the APP, and the content is also written by them. At that time, I didn’t think so much. I signed it first, but I didn’t know it was so dishonest."

On the afternoon of January 2, after many consultations, the customer service staff of Wuhan Hengxin Xingkai Automobile Sales & Service Co., Ltd. told The Paper that two solutions have been proposed at present: the first one is that the customer raises the price by 6,500 yuan to pick up the car; Second, if the customer is unwilling to add money, he can refund the deposit of 10 thousand yuan.

In view of the above, Xing Xin, a partner of Hunan Jinzhou Law Firm, believes that the car booking agreement belongs to an electronic contract, and the salesperson, as an employee of the 4S shop, has acted as a duty behavior since the salesperson sent it to Ms. Cao, which can already be regarded as an invitation issued by the 4S shop. After Ms. Cao signed the agreement, it was regarded as a promise, and at the same time, Ms. Cao paid the deposit, and the agreement was established and came into effect. "The 4S shop asked for a fare increase when communicating with Ms. Cao to pick up the car, indicating that it did not deny the validity of the agreement, and it was also regarded as a de facto recognition of the validity of the agreement."

Therefore, Xing Xin believes that the agreement does not take Ms. Cao’s car pick-up in November as a restrictive condition for the preferential car payment, and increases the price when picking up the car. Ms. Cao has the right to ask the 4S shop to continue to perform the agreement by bringing a lawsuit to the court.