A-shares ushered in the final battle in 2023 today, and the major indexes collectively closed in red, closing at the close.It rose by 0.68% to close at 2974.93 points;It rose by 0.89% to close at 9524.69 points;It rose by 0.63% to close at 1891.37 points; The Beizheng 50 Index rose 2.48% to close at 1082.68 points. The turnover of Shanghai and Shenzhen stock markets reached 822.6 billion yuan, and the northbound funds sold 566 million yuan all day. In 2023, the cumulative net purchase was 43.7 billion yuan, which was a net purchase for ten consecutive years.

Most of the industry sectors closed up.、、、、、The plate was among the top gainers.、The decline was the highest.

From the performance of the whole year, the Shanghai Composite Index rallied and fell by 3.7% in 2023, the Shenzhen Composite Index fell by 13.54%, the Growth Enterprise Market Index fell by 19.41%, and the North Securities 50 Index rose by 14.92%.

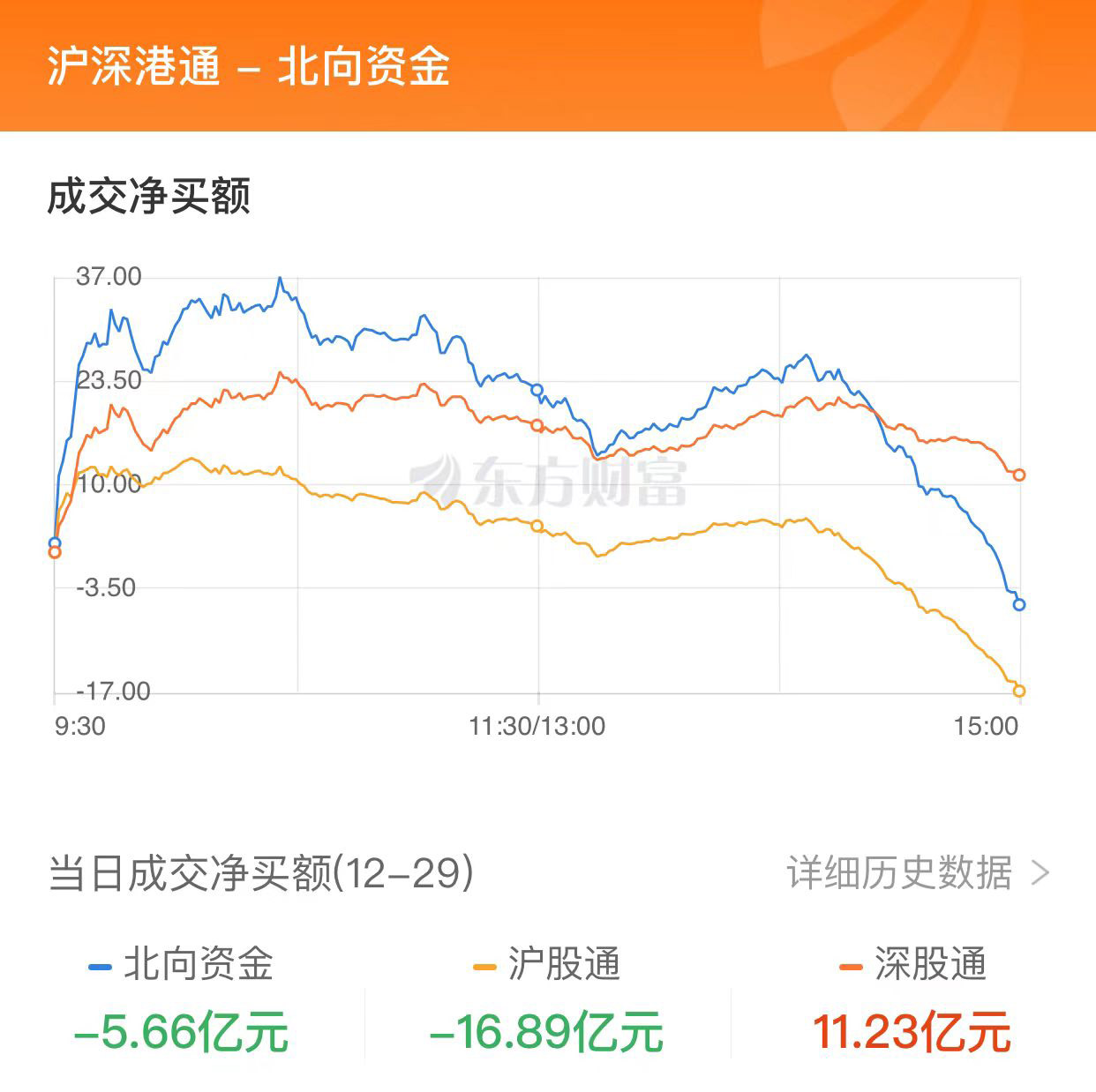

The net outflow of northbound funds was 566 million yuan.

Northbound funds flowed out today, and as of the close,The net outflow was 1.689 billion yuan,1.123 billion yuan, with a total net outflow of 566 million yuan.

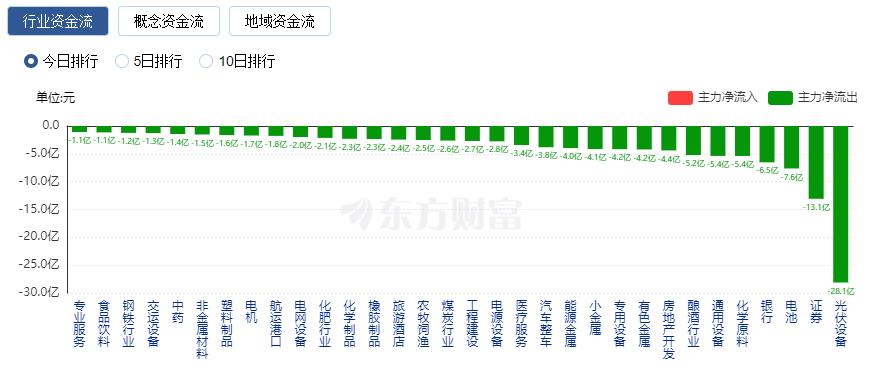

industryDirection: 1.377 billion net inflow

In terms of industry funds, as of the close, the net inflow of,, etc. ranked high, of which the net inflow of consumer electronics was 1.377 billion yuan.

In terms of net outflow,、、The net outflow ranked first, with a net outflow of 2.812 billion yuan.

Today’s news

Foreigners can open A-share accounts online. The head broker has launched this function.

Foreigners with a new permanent residence permit can open an account online! On December 28th,China reporter was informed that includingMany brokers, such as, have officially launched the online account opening function for foreigners with the new permanent residence permit, and such people can handle the A-share account opening business by themselves without leaving home. China, a brokerage firm, was informed that before this, the Beijing Securities Regulatory Bureau issued a notice requiring brokers within its jurisdiction to complete the adaptation transformation of the new version of the permanent residence permit for foreigners before the end of December 2023, so as to realize the compatibility and use of the old and new versions of the permanent residence permit and ensure that the holder can use the permanent residence permit as an identity document, handle futures trading normally and subscribe and redeem investments.Share and other related businesses, to further enhance the effectiveness of the application of the permanent residence permit.

Regulators investigate the implementation of new securities lending regulations.

China securities journal CSI Taurus reporter learned exclusively from the industry on December 29 that in order to understand the industry institutions to optimize securities lending transactions andThe implementation of securities lending transactions, the regulatory authorities recently launched in the industry..

Eight departments: explore the construction of regional artificial intelligence data processing center

The Ministry of Industry and Information Technology and other eight departments issued the Guiding Opinions on Accelerating the Transformation and Upgrading of Traditional Manufacturing Industry. Among them, it is proposed to promote the overall transformation and upgrading of industrial parks and clusters. Promote the upgrading of digital infrastructure in national high-tech zones and science and technology industrial parks, build public service platforms, explore the Sharing Manufacturing model, and implement overall digital transformation. Guided by the national advanced manufacturing clusters, we will promote the digital transformation of industrial clusters, promote online resources, flexible production capacity and industrial chain synergy, and enhance comprehensive competitiveness. Explore the construction areaData processing center, providingProcessing, generative tool development and other services to promote the empowerment of traditional manufacturing. Explore organizational forms such as platformization and networking, develop virtual parks and clusters across physical boundaries, and build a new industrial digital ecology that combines reality with reality.

Central Bank: Implement a prudent monetary policy accurately and effectively, and intensify the implementation of policies that have been introduced.

Chinese peopleThe news was released on December 28,The Policy Committee recently held a regular meeting in the fourth quarter of 2023. The meeting pointed out that a prudent monetary policy should be flexible, moderate, accurate and effective. Different from the regular meeting in the third quarter, this meeting changed the expression of monetary policy from "precise and powerful" to "precise and effective" and implemented the latest requirements of the Central Economic Work Conference.

Ministry of Commerce: Designate 2024 as the "Year of Consumption Promotion" and organize colorful consumption promotion activities.

The "2023 Consumption Boosting Year" series of activities has achieved positive results. The next step will focus on promoting the continuous expansion of consumption and set 2024 as the "Consumption Promotion Year". We will adhere to the "policy+activity" two-wheel drive, highlight key categories, festival seasons, etc., continue to organize a variety of consumption promotion activities, create more new scenes of business travel and cultural integration, and create a good consumption atmosphere.

Institutional point of view

Guosheng Securities: The New Year’s market is expected to continue, and seize the opportunity of current layout.

Guosheng Securities said that in the external environment, the Fed’s interest rate hike cycle may have ended, the US dollar index has weakened, the RMB exchange rate has continued to appreciate in recent days, and northbound funds flowed into more than 13.5 billion yuan on Thursday, providing a strong boost to the market. Domestically, the Supreme People’s Procuratorate cracked down on securities crimes such as financial fraud and market manipulation. Regulators are also encouraging listed companies to use.Tools actively return investors. The internal and external market environment has been effectively improved, market confidence has been significantly boosted, and the New Year’s market is expected to continue, grasping the current opportunity of layout. In terms of configuration, the focus is on switching the overall layout of funds in recent days.Photovoltaic, lithium battery and other directions, the relevant targets have been adjusted in the past two years, and the repair market of the plate under extreme valuation can be expected.

Bohai Securities: A-share market is about to enterVacuum period

Bohai securitiesIt is pointed out that the A-share market is about to enter a performance vacuum period. At this stage, the strength of short-term closing data is of little significance, and the fundamental information that can help long-term judgment will be more important. With the weakening of base fluctuation, economic fundamentals will face a more sustainable chain expansion process. The improvement of residents’ balance sheets will also boost the resilience of future demand recovery and enhance the medium and long-term expectations of fundamentals. In terms of industry allocation, at present, the valuation of most industries is basically in the bottom area, and there are not many fundamental catalytic factors in the performance vacuum period. Therefore, looking ahead, the driving factor at the industry level in January may still come from the capital side. Thematic opportunities at the industry level are expected to be active, and we can pay attention to the TMT plate with the electronics industry as the core under the trend of AI model from cloud to end industry, as well as the investment opportunities in the big financial, transportation and pharmaceutical industries brought by medium and long-term capital entry. In addition, we can also pay attention to the investment opportunities in the high dividend sector, the core equity variety of allocated funds.

: The corporate profit growth center is expected to be repaired.

According to the research report, the revenue of industrial enterprises above designated size increased by 6.1% year-on-year in November, 3.6 points faster than the previous value. In the first 11 months of 2023, the accumulated profits of enterprises above designated size were -4.4% year-on-year, and the annual negative growth was a high probability. However, judging from the current marginal changes, some positive signals are happening, and the period of maximum profit pressure in the year has passed. Looking back, with the gradual improvement of exports,After the national debt is put into use and the "three major projects" are started, the profit growth center of enterprises is expected to be further repaired.

: Short-term suggestion attention、、Waiting for investment opportunities

It is indicated that the average P/E ratios of the Shanghai Composite Index and the Growth Enterprise Market Index are 11.60 times and 31.42 times respectively, which are below the median level in the past three years, and the market valuation is still in a low region, which is suitable for medium and long-term layout. The turnover of the two cities on Wednesday was 652.7 billion yuan, which was below the median daily turnover in the past three years. Marginal improvement of the economy, export recovery;andRun in a low position. The employment data in the United States is good, and the Fed’s interest rate cut is expected to be delayed. In the future, the overall stock index is expected to maintain a volatile pattern, and at the same time, it is still necessary to pay close attention to the changes in policy, capital and external factors. We advise investors to pay short-term attention to investment opportunities in industries such as,, and consumption.

A-shares may exceed expectations in 2024, and there are still many policies worth looking forward to.

Chief strategistSheng Wang said that the market’s expectations for the future are relatively low now, which makes it easy to exceed expectations in 2024. In addition, Sheng Wang believes that there are still many policies to activate the capital market, improve the quality of listed companies and attract medium and long-term capital to enter the market in 2024. The continuous improvement of the quality of A-share listed companies will lay a solid foundation for the medium and long-term performance of the market.