A paper announcement made Guanzhi return to the center of the stage again.

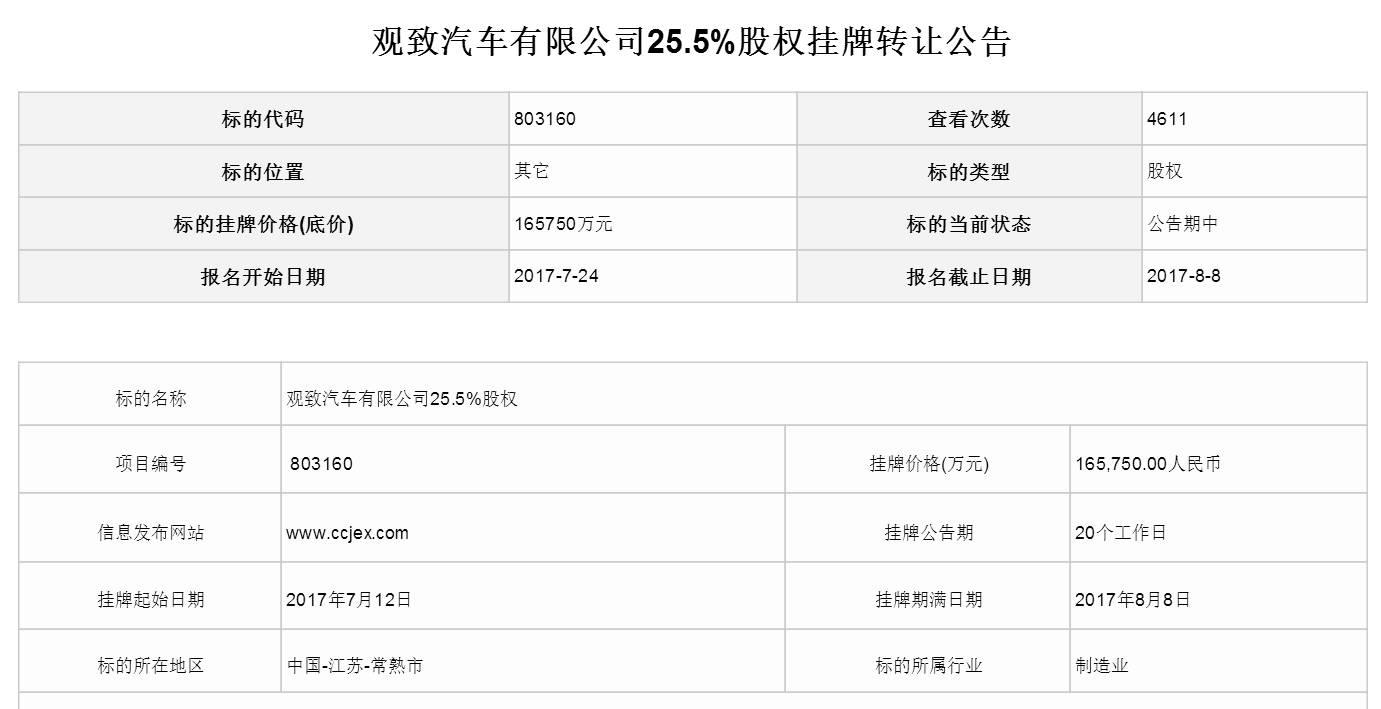

On July 12, an announcement appeared in the column of "Listed Projects" of the Yangtze River Property Rights Exchange. Title: Announcement on Listing and Transfer of 25.5% Equity of Qoros Automobile Co., Ltd. The announcement was presented in tabular form, with the target name of 25.5% equity of Qoros Automobile Co., Ltd. and the listing price of 1,657.5 million yuan. The registration start date is July 24, 2017, the listing expiration date is August 8, 2017, the listing announcement period is 20 working days, and the registration date is only 12 working days.

Previously, it has been widely rumored that Baoneng will buy a 51% stake in Qoros for 6.5 billion yuan. However, Guanzhi has never publicly acknowledged it, and Baoneng has also kept his mouth shut and is in an extremely low-key state. Now, what does this paper announcement explain?

1 Why must Qoros transfer its equity be listed?

Che Jujun interviewed an industry insider who is familiar with property rights transactions. He said that the reason is simple: generally, there are three situations involving property rights transactions. Listed companies can change their shares in the stock exchange, and non-listed companies can trade independently. However, non-listed companies with state-owned assets background must be approved by the higher authorities and SASAC before they can transfer their shares in the property rights exchange.

"This is mainly to prevent the loss of state-owned assets." The industry insider concluded.

According to public information, the Chinese shareholder of Qoros is Wuhu Chery Automobile Investment Co., Ltd., which also has two shareholders: Wuhu Purui Automobile Investment Co., Ltd. (53.48%) and Changshu Port Development and Construction Co., Ltd. (46.52%). Obviously, China has a state-owned background. In this announcement, the column of enterprise nature also indicates "state-owned shareholding enterprises". In the column of approving the competent department, it is listed as: Chery Automobile Co., Ltd.

Then, listing on the property rights exchange is reasonable.

How much should the new shareholders pay for the 51% equity?

On June 16th this year, Kenon Holdings, the parent company of Quantum (2007) LLC, the foreign shareholder of Qoros, announced in official website that Qoros, Quantum and Wuhu Chery Automobile Investment Co., Ltd. had reached an investment agreement with an investor from China. According to the agreement, new investors will invest about 6.5 billion yuan in Qoros Auto to gain a controlling stake.

Original text: (4 parties) Have entered into an investment agreement that provides for the new investor investing approximate RMB 6.5 billion (approximate $942. million) in Qoros for a controlling interest in Qoros。

Che Jujun got inside information that the new owner is Baoneng Group. It will acquire 51% equity of Qoros, while the original shareholders will each give up 25.5%, and finally form a new joint venture form of Baoneng (51%), Wuhu Chery (24.5%) and Quantum(24.5%).

As soon as the two news merge, a preliminary inference is drawn: Baoneng will acquire 51% equity of Qoros for 6.5 billion yuan.

But this is very different from the content of today’s equity transfer announcement.

According to the announcement, the price of 25.5% equity to be transferred by Chinese shareholders is 1,657.5 million yuan, and if foreign shareholders act in a reciprocal manner, Baoneng will acquire 51% equity of Qoros for 3,315 million yuan.

Wait, this is half less than the "6.5 billion yuan to acquire 51% equity of Qoros" inferred by the industry before!

Che Jujun speculated that there may be these reasons. First, either there is something wrong with the wording in Kenon Holdings’ statement. 25.5% of the shares are listed at 1.6575 billion yuan, and the 100% of the shares are just 6.5 billion yuan-exactly the same as the amount of money in Kenon Holdings’ statement in June, the only difference is that the share ratio is inconsistent. Could it be that Bao Neng later raised his sword to bargain? Second, either the valuation of Qoros fell by half a month later.

Some people say that Kenon’s statement only mentioned 6.5 billion yuan and the controlling stake, but did not mention the specific share ratio. Therefore, they believe that the controlling stake is not necessarily 51%, as long as the new investor’s share ratio is the largest, it can also be said that it has control, such as 40%, 30% and 30% equity distribution.

But this statement is even more untenable. Because, if this is the case, 40% of the equity of Qoros is worth 6.5 billion yuan, then its overall valuation is as high as 16.3 billion yuan, which is in the opposite direction. In fact, the announcement clearly stated the valuation of Qoros: 6.428 billion yuan.

That can only be said: from June to July, the valuation of Qoros has shrunk by half?

The third possibility is that we have misunderstood the announcement. Che Jujun noticed a detail: the 1.6575 billion yuan in the announcement is only the "target listing price (reserve price)". This reserve price may only be the starting price. In the actual auction in the future, if multiple bidders raise their prices one after another, they will eventually clinch a deal at a price of about 3.25 billion yuan. Then this corresponds to "6.5 billion yuan 51% equity".

Of course, the above scenario is only hypothetical, and the actual result is subject to official news.

3 data doubt: the loss is 600 million less and the net assets are 3 billion more?

According to the annual report of Kenon Holdings, the sales revenue of Qoros in 2016 was 2.5 billion yuan and the loss was 1.9 billion yuan. In this equity transfer announcement, an audit institution named Huapu Tianjian Certified Public Accountants gave a different set of data: Qoros’ operating income in 2016 was 2.6 billion and its loss was 1.3 billion yuan. Why did the loss drop by 600 million yuan? This change is surprising.

Similarly, even according to the data listed in the announcement, the owner’s equity (equivalent to net assets) given by Huapu Tianjian at the end of 2016 was 3.33 billion, while the book value of net assets given by an evaluation agency named "Zhongshui Zhiyuan" was 4.58 billion, and the evaluation value was 6.43 billion. Two adjacent tables in an announcement have doubled the net assets of the same company in the same period.

This is somewhat incredible.

Of course, this announcement involving billions will not be so sloppy, it has found its own rhetoric. In the column of "other disclosures", there are two meaningful explanations: First, Huapu Tianjian did not obtain sufficient audit evidence from Guanzhi, "it is impossible to determine whether it is necessary to adjust the book value of intangible assets and issue a qualified opinion." Second, Zhongshui Zhiyuan adopted the "income method" to evaluate the assets of Qoros.

An industry insider who is familiar with asset operation explains this: technical patents, intellectual property rights, goodwill and trade secrets can all be included in the asset value after evaluation. In addition, the positive expectation of future performance can also increase the valuation of enterprises-if the evaluation agency adopts the "income method".

As far as the first item is concerned, Che Jujun has a little understanding of why Qoros once again mentioned the QamFree engine technology developed with Koenigsegg’s assistance, the European NCAP 5 Star, the Red Dot Design Honor Award and the China brand new car quality first. . . . . . Can you increase sales aside, at least it can increase the valuation of billions-Qoros should add chicken legs to the marketing department and public relations department.

As for the second item, the psychological expectation of the audience can be effectively improved through communication:

According to public reports, Qoros’ recent propaganda offensive is extremely fierce: launching a live car show of Crazy Qoros with Tencent Video, sponsoring the China GT China Super Sports Car Championship, launching a sub-brand Model Young in the second half of the year, and launching three products in the next 12 months. The Model-K EV unveiled at the Shanghai Auto Show is scheduled for mass production in 2019. . . . . .

Everything seems to be thriving, but through this bustling, Che Jujun discovered the cold fact.

4. The production time of Changshu factory will not exceed 10 days after the year?

According to the data of the Association, the cumulative sales volume of Qoros in the first half of 2017 was 5,962 vehicles, down 40% year-on-year. A more surprising phenomenon is that in the production and sales data of the Association, the output of Qoros in June was 0.

Che Jujun got a fright, and quickly found the output data of Guanzhi in the first half of the year. See the list:

Have you found the pattern? Since the beginning of 2017, the production of Guanzhi Changshu Factory is relatively "big month" in odd months and "small month" in even months. For example, in January, March and May, the output of more than 1,000 units per month, but in February, April and June, the output was 79 units, 75 units and 0 units respectively.

As we all know, the big reason is that the sales volume of Qoros has been poor, and the whole automobile market has been cold this year, which is even worse. But some friends may ask: then why not produce all the cars at once, isn’t that more cost-saving?

Otherwise. First of all, this will give consumers a "stock car" and reduce their fragile willingness to buy.

Secondly, from the practice of automobile manufacturing, the best way to maintain the production line is to keep it running moderately all the time. If it is stopped for a long time and suddenly put into production, all kinds of faults may occur, such as aging and failure of parts, leakage of lubricating oil, improper adjustment of work station and workers’ operation mistakes. Therefore, the general OEM should build cars even in the off-season.

The same is true for Guanzhi. Odd months are normal production and even months are "maintenance" operation. Until June of this year, even this basic operation was unable to bear, and production was simply stopped.

According to the data of the Association, the cumulative sales volume of Qoros in the first half of the year was 5,962 vehicles, down 40% year-on-year. The output was 5,167 vehicles, down 56% year-on-year. In other words, in the first half of this year, 800 units were produced less than those sold, because last year’s inventory was digested. Therefore, the forum often asks prospective car owners to post: Can Qoros, which has been in stock for half a year, buy it?

For the sake of accuracy, Che Jujun interviewed an employee of the Guanzhi Changshu factory. He said: The production time after the year is less than 10 days.

Che Jujun was shocked again.

In an interview with the production manager of another car company, he analyzed: At present, the production rhythm of car companies is around 60JPH, that is, a new car is off the assembly line in one minute, and the slower one is 30JPH, that is, a new car is off the assembly line in two minutes. In terms of running time, it is common for the best-selling manufacturers to spend more than ten hours a day, and the poor sales can also open for 8 hours.

According to the report, the production rhythm of Qoros Factory is 36JPH, that is, 36 new cars per hour, and the minimum production time is 8 hours (for reasons below). The output on that day is 288, so the total output in ten days is 2,880.

According to the data of the Association, Qoros produced a total of 2,709 vehicles from March to June-just less than the output of 2,880 days. It seems that the statement that the production time is less than 10 days after the year is basically true.

How do the workers in Changshu factory feel about this bleak output?

A user whose ID is "Call of Doomsday" asked in the post bar: How about Guanzhi Changshu Factory? Why is the internship only 1950 yuan?

Che Jujun was shocked again. Let the post-90s generation get a monthly salary of 1950 yuan in the Yangtze River Delta? Can such treatment create a luxury "A New Premium" car?

The reply was really full of complaints. A suspected regular employee shares: 2300 basic salary +450 fixed allowance after becoming a regular employee, and get 2500-2600 a month without overtime after paying five insurances and one gold. There are also employees who add: I usually work for 7 days and have 7 days off. If I go to work, I usually get off work at 5 o’clock and have a weekend. But when you are busy, you will also be urged to work overtime-you have to work overtime during the Mid-Autumn Festival. Last year, I had a long vacation from June until July. It is estimated that the holiday will be longer this year.

Che Jujun inadvertently found a sad post.

"I am a Korean, working as a secretary for Korean leaders for 5 years, and then working as a clerk in Changshu Qoros Automobile. Now, due to the poor efficiency of the company, I often have holidays, so I want to teach Korean part-time and the price is negotiable. "

5 How much is Guanzhi worth now?

This is a difficult question to answer. According to the valuation on the listing transfer announcement, it is 6.428 billion yuan. It sounds a lot. After all, Volvo sold it to Geely for only $1.8 billion, equivalent to RMB 12.3 billion. Geely’s 51% stake in Lotus only cost 450 million yuan.

If roughly equated, it can be said that the current valuation of Qoros is equal to 0.5 Volvo and 7 Lotus.

Regardless of whether Baoneng won the bid in the end, the new controlling party must first face a grim reality: how to stop losses. After all, Qoros is not a listed company like Tesla. It can rely on news events to stimulate the capital market with losses, and finally let the market pay for it.

Guanzhi burns investors’ money, and the profit cycle of electric vehicles will be extremely long-Tesla, the object of its tribute, has been profitable for only two quarters in the past seven years. And the strength is far less than Tesla’s Guanzhi. How many years will it take on the road of electric vehicles to bring positive returns to investors?

According to public information, Qoros lost a total of 8.74 billion yuan from its own financial report to 2016, and lost 640 million yuan in the first half of 2017, which is equivalent to its accumulated loss of 9.4 billion yuan.

In addition to stopping losses, new investors have to invest more money for the future development of Qoros. Take Volvo as an example. Although the acquisition cost only $1.8 billion, the subsequent investment of $11 billion was used to develop a brand-new SPA platform architecture and VEA engine cluster. As the saying goes, it is difficult to start a family, and it is even harder to support a family.

Without the accumulated investment of 100 billion RMB, it is difficult for you to make a decent international automobile brand from scratch.

According to the Hurun Rich List in 2016, the wealth of Baoneng boss Yao Zhenhua rose by 820% to 115 billion yuan, ranking fourth. In other words, if Mr. Yao wants to realize his dream of building a car through Guanzhi, he has to invest almost all his money. Moreover, success and making money are not the same thing. See Tesla for details. If you make money by being "China’s Tesla"-wait, isn’t Tesla going to be made in China soon?

Of course, if it is not a strategic investment but a financial investment, it is another story.

Summary of car gathering:

If there is no accident, Baoneng will pay at least 1.658 billion yuan to Wuhu Chery Automobile Investment Co., Ltd. in August. Because the payment method listed in the announcement is that the transferee will pay all the transfer price of the target in one lump sum within 5 working days from the effective date of the Property Rights Transaction Contract.

Prior to this, Baoneng kept a low profile, even found some mainstream media and negotiated to delete articles related to Guanzhi. "Personally, this may be to prevent opponents from joining the bidding ranks after hearing the news to the maximum extent, thus increasing the purchase cost of Baoneng." An investment person told Che Jujun this way.

On that day, Kenon Holdings’ share price closed at $13.36, a slight increase of 0.38%. (Source: Cheju.com Tuobachong)